Economic Analysis

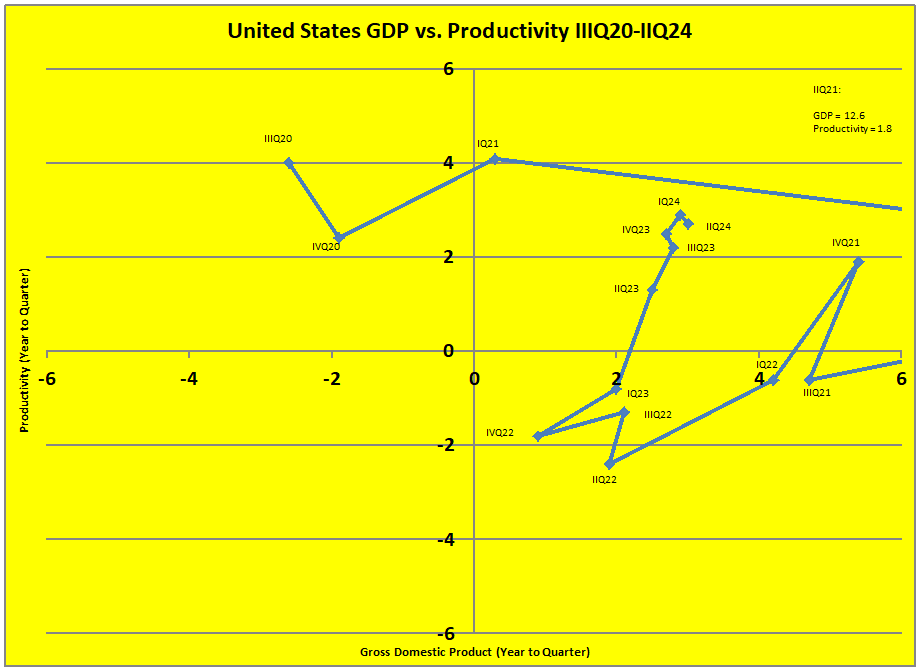

Unless otherwise stated all references to Gross Domestic Product (GDP) or Productivity is based on year to quarter data. For reasons of continuity and comparisons with previous plots, the limits on the present graph has remained the same as before even though the economic decline or accelleration exceeds those limits. This analysis is based on data obtained from reports issued by the United States Bureau of Economic Analysis and the Department of Labor Statistics.

Productivity

Productivity growth during the fourth quarter of 2024 was 2.0%. The BEA quotes 1.5% for the period (third to fourth quarter). We work on a yearly basis. 2.0% is the same as the third quarter. Pre-1973 productivity averaged 3.0%. Post 1973, it averaged 0.9%. Long term growth (over 50 years) is 2.7%. Productivity growth is at its historical average range and probably will contine to hover around that point. It is higher than has been the case post 1973. Some people feel that productivity will move higher. I find no evidence that would suggest so.

Productivity may of been higher during portions of the covid years but this could not be taken as "normal."

Also, the higher the economy grows, the more difficut it will be to raise productivity. It can be done, but it would not be likely.

Economy

The Bureau of Economic Analysis (BEA) states that the rate of GDP advancement for the fourth quarter of 2024 was 2.4%. We believe 2.9% is a more accurate figure. Long term growth, historicaly has been 3.18%.

For a developed economy, a growth rate of 2 to 3% is considered normal. A growth rate above that level and strong job cretation is a strong sign that the economy is prospering.

The botomline is that economy is prospering and doing far better than many of the other developed nations.

Side note: Rapid growth can bring on more inflation, though, because of high demand and low supplies. We need to be cautious about the possibility. Lower inflation will not bring prices down as long as consumers continue to buy.

Also, prices today were baked into the system six months or more ago. They will not go down. The best that you could hope for is that they will not rise as much in the future. A question mark is tariffs. As a negoiating tool or not, it will raise prices, if only in the short run.

Considering all the natural and man-made factors, I expect inflation to go higher.

Raymond D. Matkowsky

|